In our last article, we dove into the topic of PO Financing and why Canoo cares about its initial customers credit ratings. While writing that up, we took a closer look at the Walmart Fleet Purchase Agreement contract and determined it deserved it's own article. We've mentioned before that Walmart might be paying as little as $30k per unit, but now feel that is just wrong.

There are three distinct aspects to the Walmart/Canoo EV Fleet Purchase Agreement that we'll look at: Warrants, Vehicle Pricing and Synergies.

Warrants

Canoo entered into a Warrant Issuance Agreement with Walmart to purchase an aggregate of 61.2 million shares of Common Stock, at an exercise price of $2.15 per share, which at the time, represented approximately 20% ownership of Canoo on a fully diluted basis.

15.3 Million warrants would vest right away, and the rest would vest to Walmart on a quarterly basis as they pay money toward Canoo up to $300 million. We'll come back to this later but It's important to point out that the terms specifically state "any net revenue attributable to any products or services offered by Walmart or its affiliates related to the Company, until such net revenue equals $300 million, at which time the Warrants will have vested fully".

If you don't know what a warrant is, it's basically a contract to purchase a share at the stated price - no matter what the actual share is trading at on the open market. If Walmart exercises any of these warrants, they pay $2.15 for each warrant directly to Canoo in return for a single common shares. Currently Canoo stock is trading below $2.15, so don't expect to see Walmart exercise them any time soon, unless they do so in order to throw Canoo a bone and to help LDVs get out to door faster but that is not likely to happen.

For the sake of an easy explanation, lets make up a scenario where Canoo is trading at $10 in the year 2025 and Walmart has paid $300M in revenue to Canoo and thus all 61.2M warrants are vested and belong to Walmart. In order to exercise the warrants they would pay $131.5M(61.2M * $2.15) to Canoo in cash and receive $612M(61.2 * $10) worth of shares. In this scenario, Walmart has paid out $431.5M to Canoo and not only have they received a spiffy fleet of EVs but also profited $180.5M on top from holding equity in Canoo. We can see that Walmart is very well incentivized to help Canoo succeed outside of just wanting to own best in class delivery vehicles.

Cost per Unit.

We don't expect Walmart or Canoo to openly say what the cost per unit is for the LDVs, just like neither Amazon or Rivian have divulged the pricing on their Electric Delivery Vehicles. Canoo submitted a copy of the contract between them and Walmart, but it had specifics including pricing redacted. That doesn't mean we can't come up with an average price and extrapolate on some items to give ourselves a better idea of what pricing might look like.

When the initial announcement came out, all the Press Release told us is that Walmart signed an order for 4500 units, with the option to purchase up to 10,000 units. During the Q2 FY22 ER, which happened just after the Walmart announcement, Tony remarked the deal represented $300M and filings showed us the purchase agreement was over 5 years.

As we said in the intro of this article, we had previously mentioned elsewhere the price could be as low as $30k per unit. The reason we suggested this was because it's the most conservative and easy answer to give. $300M for up to 10,000 units would $30k each. However, realistically $30k isn't just cheap, it's absurdly cheap!!

Lets consider the actual quote from the ER: "The first agreement represents $300 million of potential revenue for us with an additional path of deeper partnership opportunities to generate revenue for us with our new partner...This is our first key commercial fleet agreement that further allows us to focus on the larger volume, higher margin revenue opportunities, which includes revenues from upfitting and other non-vehicle revenues, starting with 4,500 vehicles with an option to increase to 10,000 vehicles."

We read that as being $300M for 4500 units, or an average price of just under $67k per unit.

Admittedly $67k sounds too expensive given the MSRP is supposed to be around $40k. However, when adding in the potential for upfitting and software fleet services then it begins to sound actually quite reasonable especially since It has been claimed by analysts on twitter that Amazon is buying the Rivian EDVs for $78,066, which we assume also includes upfitting and other possible software revenues.

Does this mean the entire 10,000 vehicle order can be extrapolated to being worth a lump sum of $670M? Probably not - as the "non-vehicle revenues" might not scale across each LDV sold. We could imagine a up front fee for developing the software and then some kind of subscription fee thereafter perhaps. Lets make some assumptions here to break it down further and say Walmart is paying MSRP $40k for each LDV unit, that leaves $26.7k split between the upfitting and software. $10k in upfitting doesn't sound outrageous for a completely custom proprietary system that is mission critical in the battle against Amazon in the Last Mile Space. This leaves $16.7k for "non-vehicle" revenues.

$40,000 * 4,500 = $180M in LDVs

$10,000 * 4,500 = $45M in Upfitting

$16,666 * 4500 = $75M in Software

If the entire vehicle package costs $50,000 and, being conservative, we say that the software package is paid up front in the first 4500 order, then the other optional 5500 vehicles will be another $275M in revenues, not counting any extra software subscriptions costs. If our estimates are correct or at least close enough, this would bring the tally to $575M for the first 10,000 EVs sold to Walmart.

Synergies

We have a loose end to tie up from our warrant discussion. Recall we quoted the terms of the warrants would vest from "any net revenue attributable to any products or services" this means that the non-vehicle revenues will count toward the vesting schedule. We already mentioned Canoo's Fleet Management software and this is just one aspect of some non-vehicle revenues. Although not likely to affect Canoo's revenues until they shift focus away from just commercial fleets, we are excited by the potential synergies to come from the Walmart partnership on the software side.

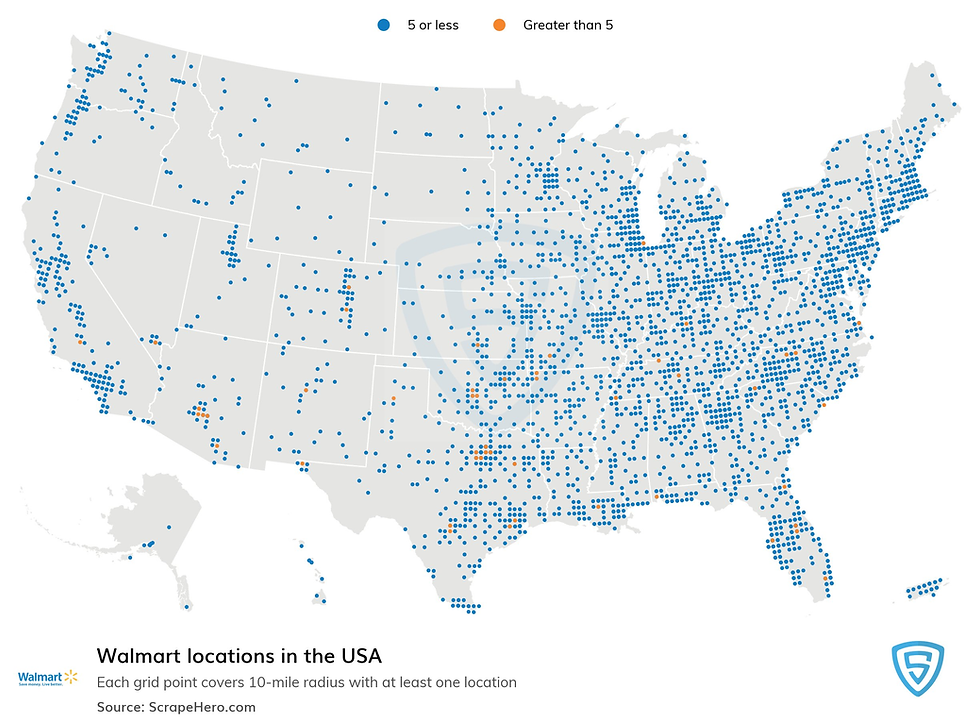

For example, Walmart currently has 4650 stores across the US and 2500 of these locations can do simple automotive servicing such as tire changes. A Canoo owner might get a notification on the Canoo App that they will soon be in need of tires and there could be a promotional discount for them if they get new tires at Walmart or maybe a coupon on some coolant for their non-Canoo ICE vehicle. In this scenario, Canoo would see revenues from Walmart for driving traffic to their stores. Along this same line, Walmart could offer to Canoo their automotive locations as service/warranty centers for simple repairs, giving peace of mind to customers and allowing Canoo to expand their footprint without the expensive capital requirements of building out as many locations. These are just a couple of the hypothetical scenarios we could see happening, but it bears repeating - we are excited at the potential!

Do you have your own ideas on how much each vehicle will cost, or some other areas you think the Walmart Partnership can shine? Please share them below in the comment section or tweet us @Canooers!

Note: We didn't want to get too deep into the weeds on the subject, so we purposefully didn't discuss the warrants having an anti-dilution clause which affects the terms of the warrants or that there is a shareholder vote to approve a portion of the warrants nor the possibility that other trim models other than LDV could be included in the purchase agreement.

Authors disclosures: I am long Canoo - I own common shares, warrants and call options.

Comments